There’s a lot of advice out at the moment from different governments around the world, all trying to protect their citizens from Covid-19. The key points from these pieces of advice are to avoid contact as much as possible and to keep washing your hands.

But there is a situation where people frequently exchange items and hoard those items in their pockets next to tissues or handkerchiefs. These items are bank notes. The World Health Organisation has stated that the Coronavirus can survive on bank notes for several days. Infected cash may be passed through the hands of several people, thereby spreading the virus. The most concerning point is that cash is commonly used for paying for food and people often handle cash and food without washing their hands in between.

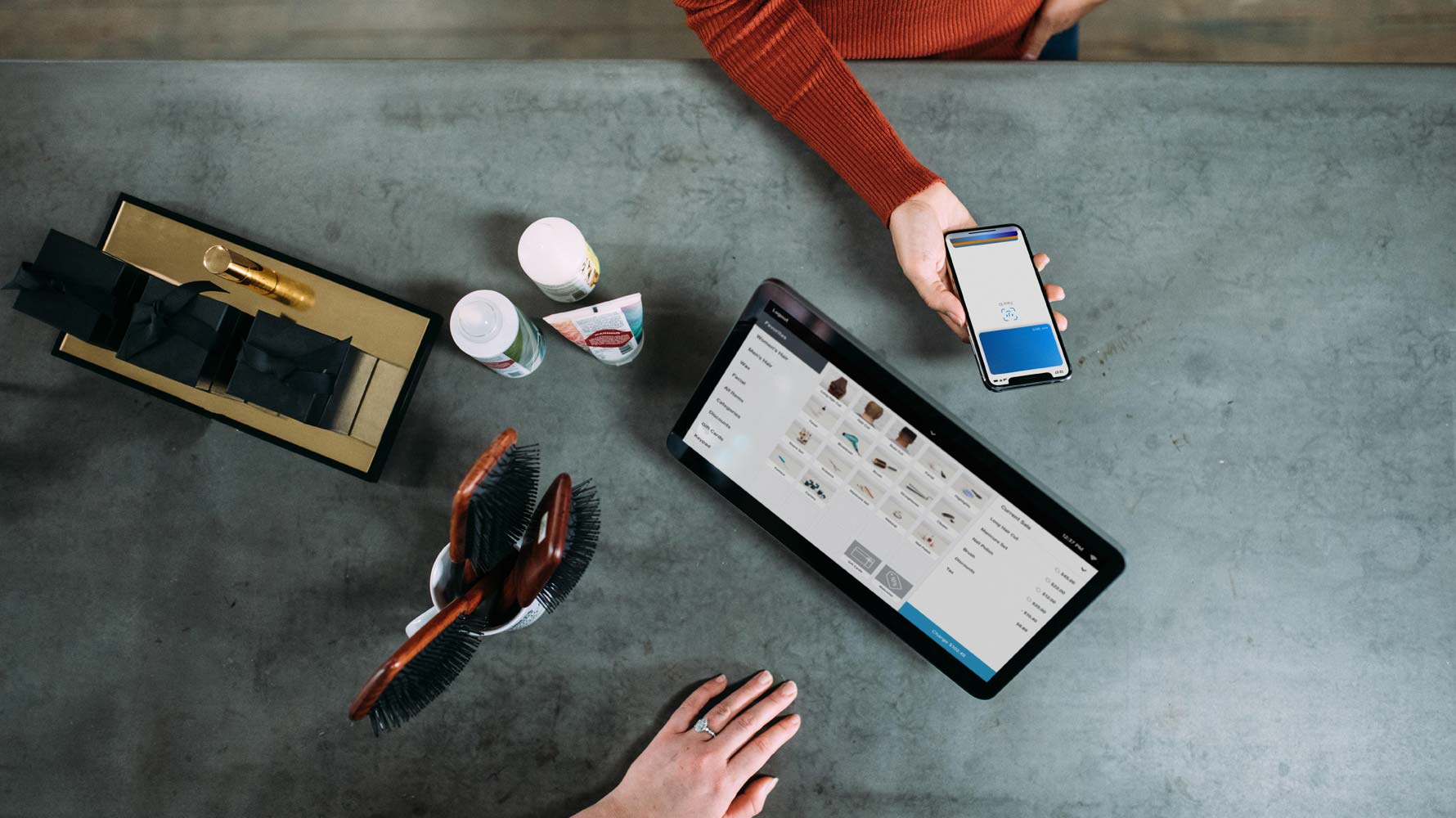

Going cashless

Don’t worry, the majority of retailers around the world now accept contactless payments. You can pay without having to touch cash at all. You simply hover your own card over a payment terminal to make a payment. Your hands are safe!

There is, however, a snag with contactless. Unless you have a new biometric payment card with a built-in fingerprint reader, you will have to enter a PIN on a terminal in order to authorize some payments. Contactless payments have a maximum payment amount (typically £30 / $30) and under the new PSD2 rules. Often, you can only make five small transactions before a PIN is required. And pin pad terminals can get infected too. Ask yourself, who used the keypad before you and did they wash their hands?

Mobile payments

We do, however, have the solution in our pockets – our mobile phones. The majority of mobile phones now have a payment app that will allow you to set up your regular plastic card to be used digitally on your phone. Apple Pay is probably the most known of these apps, but there is also Google Pay, Samsung Pay, Huawei Pay, and several others to choose from if you have an Android phone.

Mobile contactless payments do not have limitations of contactless plastic cards because the transactions are authenticated on the phone using a fingerprint or face recognition (as an alternative to a PIN). This means that we can use them on pretty much any payment terminal that accepts contactless and -unless the retailer has set up their own limits - you can use mobile payments to pay any amount required. People have even bought luxury cars using mobile payments.

Virtual cards

If you are traveling for business, you may not wish to use your own credit or debit card, or you may not have a corporate card that you can install into your mobile app. There is a solution in the form of Virtual Cards. A virtual card is a digital credit card that can be used online or installed into a mobile wallet. Once installed in the app, it may be used just like a regular plastic card in any store, café, and hotel that takes contactless cards. You may use it just like cash.

The great thing about virtual cards is that they can be created for individuals with allocated spend limits and specified expiry date. This means that a virtual card can be created for an individual traveler for a specific trip, with an allocated budget. If there is a disruption and the traveler needs to stay longer or has to pay for something unexpected during the trip, the credit limit and expiry date may be changed.

The cards are also excellent for setting up for an interview candidate or guest you are hosting. Just send them an email with a link to the virtual card, they click a link and they have the funding mechanism directly on their phone. The virtual card will then appear next to the traveler’s personal cards in their mobile wallet. The card can be selected and the traveler can pay using their phone.

It doesn’t even have to be a phone. You can now pay using virtual contactless cards from a smartwatch.

No dirty money, no dirty PIN pad, no contact. Listen to the latest podcast episode of On The Fly.