The transformation of airline retailing

In our modern economy experiences create more value than goods and services, making experience a key competitive differentiator, especially in the $8+ trillion global travel industry. It’s a chief motivator of the airlines who have invested billions in cabin, airport, lounge and digital upgrades to improve the traveler experience.

Yet, while at the forefront for many years, the legacy indirect distribution technology and standards have not allowed airlines the flexibility to differentiate products and experiences the same way they can via their websites, direct to customer. This created an imbalanced traveler experience.

To address this, the airlines embarked on an ambitious journey to transform airline retailing and modernize the now outdated technology and standards that served the industry well over the years, into a true digital retailing experience.

The enhancements promise to deliver richer, more relevant content through value-based pricing, convenience, and choice for travelers, across all distribution channels. There are three key components that are required to make this rich content come to life – distribution, content and display.

Our approach

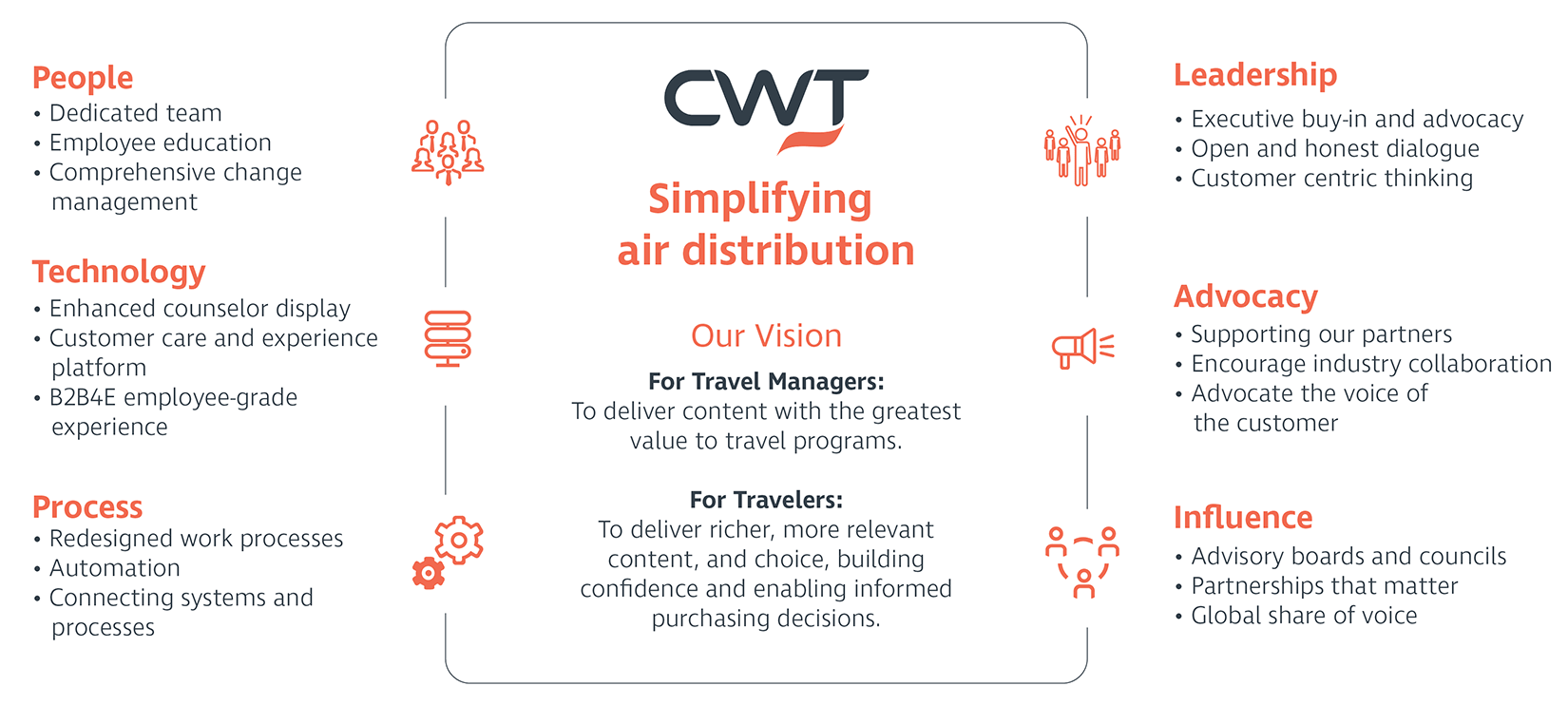

CWT continues to be an early adopter, advocate and influencer in the New Distribution Capability (NDC) journey. We are in the midst of a transformational change in the industry, and we have a clear strategy to benefit our customers now and as NDC evolves.

Delivering a truly digital retailing experience begins with NDC as the foundation. But while NDC is simply a standard for exchange of data between airlines and indirect distribution partners, it is not simply a technology upgrade with relevance only to the IT department.

NDC enabled content will fundamentally change air distribution. It requires transformational change to deliver its promise of richer content, convenience, and choice. At CWT we are delivering against this challenge through our people, processes and technology, and supporting industry momentum through leadership, advocacy and influence.

We are focused on advocating for and building a multi-channel solution that makes it easier to understand and purchase rich content across all airlines. Our platform strategy allows us to remove air content distribution barriers for clients and suppliers, and by supporting collaboration across the industry we are helping drive new innovative approaches and evolve the NDC offering. We have a clear vision and use our influence to advocate for the unique needs of business travelers.

Understanding NDC

![]() New Distribution Capability (NDC) itself is simply a standard for exchange of data between airlines and indirect distribution partners based on modern technology, giving the airlines the capability to provide richer content, ancillaries, personalization and dynamic offers through an NDC-enabled channel.

New Distribution Capability (NDC) itself is simply a standard for exchange of data between airlines and indirect distribution partners based on modern technology, giving the airlines the capability to provide richer content, ancillaries, personalization and dynamic offers through an NDC-enabled channel.

It provides indirect distribution channels the building blocks to match the capabilities of an airline’s website and allows them to improve the experience for both travel buyers and sellers.

Understanding the future of Content

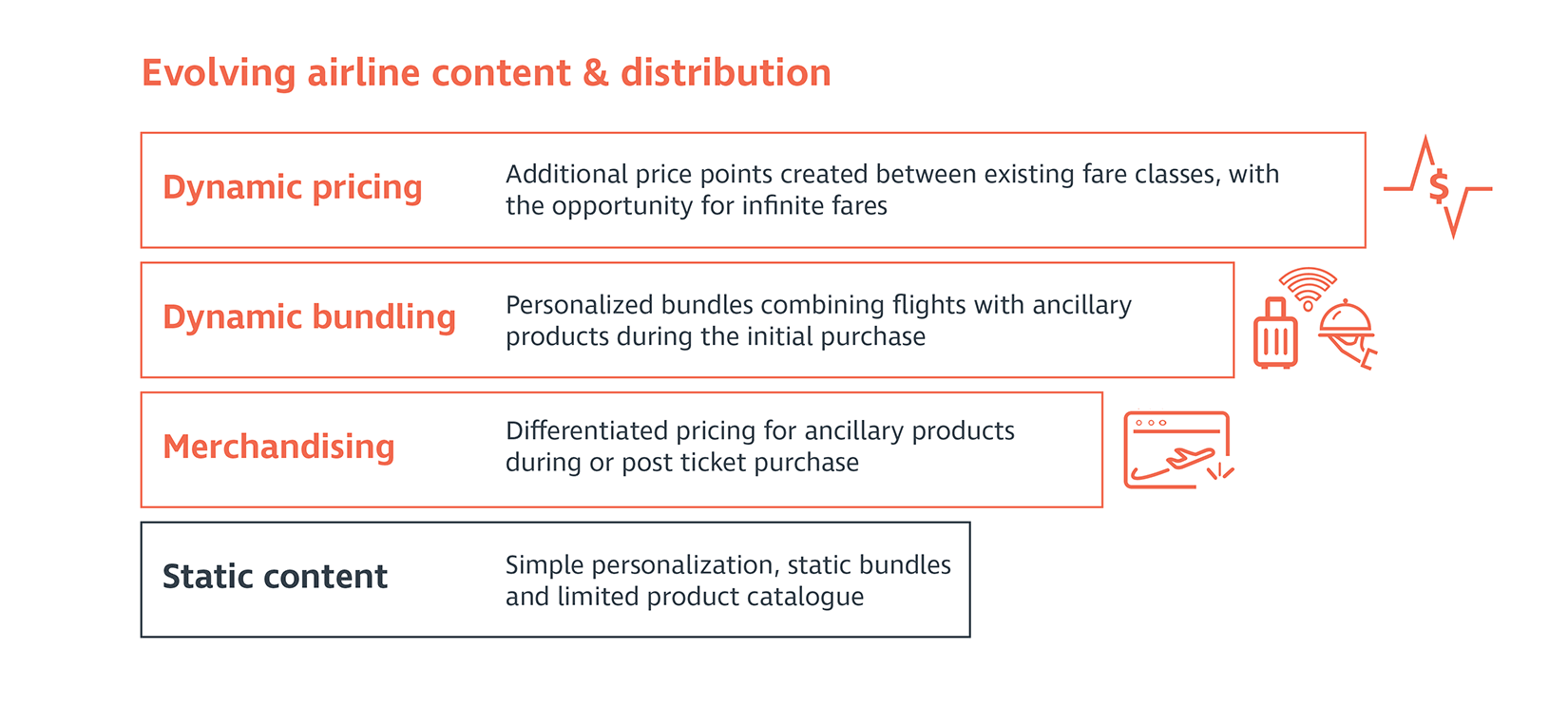

![]() The key driver for NDC adoption is new content and capabilities that have not to date been possible using existing indirect channel technology.

The key driver for NDC adoption is new content and capabilities that have not to date been possible using existing indirect channel technology.

Airlines are focused on three broad categories to improve experience and profitability – merchandising, dynamic bundling and dynamic pricing.

Securing access to relevant air content and capabilities in the most efficient manner requires a multi-sourced approach. By leveraging all available channels and providers (legacy and emerging), travelers and travel programs will have access to relevant content as well as the capabilities to support travelers and travel program needs. CWT is working closely with our technology partners to deliver scalable solutions for NDC content leveraging airline APIs at the heart of their distribution platforms.

We are beginning to achieve some large milestones for NDC content and distribution, taking us from purely theory to practice however, broader adoption will remain limited until NDC content matures. Our blog, (NDC: Reflecting on 2023 and priorities for 2024) includes some of the markets and airlines we have expanded access to during this phase of the NDC rollout.

Understanding the future of display

![]() NDC addresses the airlines' desire to make rich content available via any channel but does not address the challenge of displaying that rich content at the point of sale. A critical enabler of NDC content will be the ability to provide an enhanced display for counselors and travelers.

NDC addresses the airlines' desire to make rich content available via any channel but does not address the challenge of displaying that rich content at the point of sale. A critical enabler of NDC content will be the ability to provide an enhanced display for counselors and travelers.

For business travelers, the ability to manage complex requirements, such as voluntary and involuntary flight changes, ancillary add-ons and complex fare options, through a user-friendly display will be critical to building confidence in NDC and enabling informed purchasing decisions.

Through our blogs such as (Display and going the last mile) and (Tipping the scale of NDC adoption), CWT has been passionate about the need for a redesigned display in order to truly realise the benefits of NDC. We have been a leading voice in including the development of enhanced display interfaces as a key dependency of NDC enabled content, and partnering with various industry stakeholders to influence the prioritization and development of new display mechanisms. While these initiatives are still ongoing, we are pleased with the rise of importance and increased industry discussion on the topic.